The First Home Buyer Course.

Learn Exactly How to Buy Your First Home — Step by Step

Planning on buying your first home but don't know where to start? The First Home Buyer Course gives you the complete roadmap — everything you need to go from confused to confident.

You'll learn the exact steps to take (in the right order), how to avoid every rookie mistake, and how to make smart, stress-free decisions that get you into your first home faster.

This isn't theory. You'll be guided by two of Australia's leading Buyer's Agents, who've helped hundreds of people buy property the smart way.

👉 Get the course now and learn how to:

* Follow a proven process for buying your first home

* Avoid costly mistakes that set buyers back years

* Make confident, informed decisions at every stage

* Finally take control of your home-buying journey

Skip the overwhelm. Buy The First Home Buyer Course today and start your path to home ownership with clarity and confidence.

45+ Yrs

Nearly 50 Years Combined Real Estate Experience

1000s

Thousands Of Client Properties Bought

2000+

2000+ Buyers Supported Through Every Step

$1B+

$1Billion + Worth of Deals Negotiated

Veronica and Meighan have been featured in:

"I can honestly say, doing The First Home Buyer Course with Meighan and Veronica has taken away the fear of the unknown..."

"We went in knowing nothing and... we now have a clear plan of what is involved and what we need to look out for when the time comes! I can honestly say, doing The First Home Buyer Course with Meighan and Veronica has taken away the fear of the unknown, opened our eyes to all the possibilities and made us slow down and not rush into something just to 'get us on the ladder'. These two have so much incredible knowledge, and they genuinely want to help people to make good property decisions. Would recommend 1000%."

- Alice

So, you've reached the milestone moment, and you're ready to start your journey to homeownership...

A bloody big congrats to you, friend!

It's an exciting feeling when you're finally ready to put down roots, make an investment in your future, and escape the rental rat race.

There's so many great reasons to want to buy your first home, like...

- You want to raise your young family near good schools, and need somewhere permanent to settle down in...

- You and your partner are working hard, and you want to invest your income in an asset that will increase in value...

- Couch hopping and the rental game are getting old, and you want to kiss your landlord goodbye and live on your own terms...

- You want a home you can pass down to your kids one day, or have financial security for when you retire...

- A loved one has passed away and you've inherited money that you want to use wisely...

- It's a right of passage, and you want the satisfaction of owning your own home (y'know, so your parents can get off your back already...)

Or perhaps you're just ready to have a place that is yours. Where you can hang pictures on the wall, make the upgrades you want, and really enjoy the place you call home.

But, where the hell do you start?

While it's fun to imagine the movie-moment day when your keys are handed over, and you're eating pizza out of the box on your empty living-room floor (romantic, right?)...

Figuring out how to get from where you are to that point can be seriously overwhelming. Afterall, buying property is the single biggest investment you'll ever make in your life. It's important to get it right, or else you could be putting yourself, your future, and your family at risk! But that's easier said than done when you feel like you're navigating the journey alone...

Buying a home isn't all scouring real estate sites and touring open-houses, is it? The market is complicated. Information is confusing (and conflicting). Agents leave you feeling out of your depth. Everyone else seems to move like lightning. You're all of a sudden expected to make a huge, complex, life-changing decision before the gavel hits!

Not to mention how much noise there is in the property buying space right now! From experts, to the media, to the guy in line at the supermarket... It seems like everyone is ready to share their opinion about real estate with anyone who will listen - from what interest rates are doing, to whether the market is booming or the housing bubble is about to burst, and everything in between.

And as a result, it's easy to feel like your dreams are on ice. You want to take the next step but you're paralysed by the road ahead...

If that sounds familiar, perhaps you've also found yourself facing these other common challenges in your own first home buying journey:

Are you terrified of getting it wrong, and buying a dud property you regret? And you're not willing to forfeit your hard-earned deposit for just any old home...

Have you had bad past experiences house hunting or working with agents and brokers? And you don't want to make another mistake that costs you time and money...

Are you frustrated by just how much is out of your hands in the home buying process? And you feel powerless against interest rate changes, the property market, bank loans, house prices and more...

Are you feeling the pressure to buy your own home from family, peers, or society? And while you do want a property, you don't want to settle (it's your money after all!)

Do you feel unsure how much you can (and should) borrow for your home? And the thought of being in debt to a bank scares the hell out of you...

Have you struggled to find the right team around you to give you the information you need? And you feel like everyone has their own agenda, rather than having your best interests in mind...

Or perhaps you're just ready to have a place that is yours. Where you can hang pictures on the wall, make the upgrades you want, and really enjoy the place you call home.

While there's a lot of great reasons TO buy a home, there's also a lot of reasons NOT to

Handing over your hard-earned deposit to a bank, and making what could be the biggest purchase of your life is no small decision. And, this decision shouldn't be made just because...

You feel rushed by a pushy agent to up your offer and win the house...

The people or society around you are making you feel guilty for not...

You've got FOMO watching your friends move into their dream homes...

You've been told you need a 20% deposit, so you're just working off that...

Prices are still so high and you want to get into the market before it's too late...

You think the home you want is out of your reach, so you settle for less...

You deserve to make this move with confidence, knowing that you're making a smart decision that will benefit you and your family for years to come! You deserve to feel proud of yourself for working hard, saving your deposit, and investing wisely in your future. You deserve to know that you've got financial security that will keep you safe, no matter what curveballs life throws at you.

So, if this sounds like the pathway you'd rather follow (instead of wandering aimlessly through a sea of sleazy agents and dodgy listings)... that's where we can help. The First Home Buyer Course is the next best thing to having your very own buyer's agent, and it's only $990.

Hi, We're Veronica Morgan and Meighan Wells...

Two of Australia's leading Buyer's Agents, both probably old enough to be your mum (that's a good thing).

There's a lotta shonks on the market claiming to be "experts" with only a few sales under their belt. Not us.

With nearly 50 years of combined expertise, plus a helluva lot of our own lived experiences, we've got the know-how to get anyone into their first home. Through our highly respected Buyers Agencies, we've each purchased over a billion dollars worth of homes, and helped thousands of people get onto the property ladder.

However, we're also aware that most first home buyers can't afford to engage an experienced Buyer's Agent to support them through the process...

Instead, they're left fending for themselves, throwing offers around like confetti, and competing against those same agents on auction-day. This results in smart people making bad decisions - because they didn't know any better.

Buying your first home doesn't have to be a daunting task...

The reality is, most home buyers (not only first-time buyers!) are navigating the property-marketing blindly, with no one guiding them through exactly what needs to be done and how to do it.

As a result, they're getting the order of the steps wrong. And when things are out of order, mistakes happen... Costly mistakes.

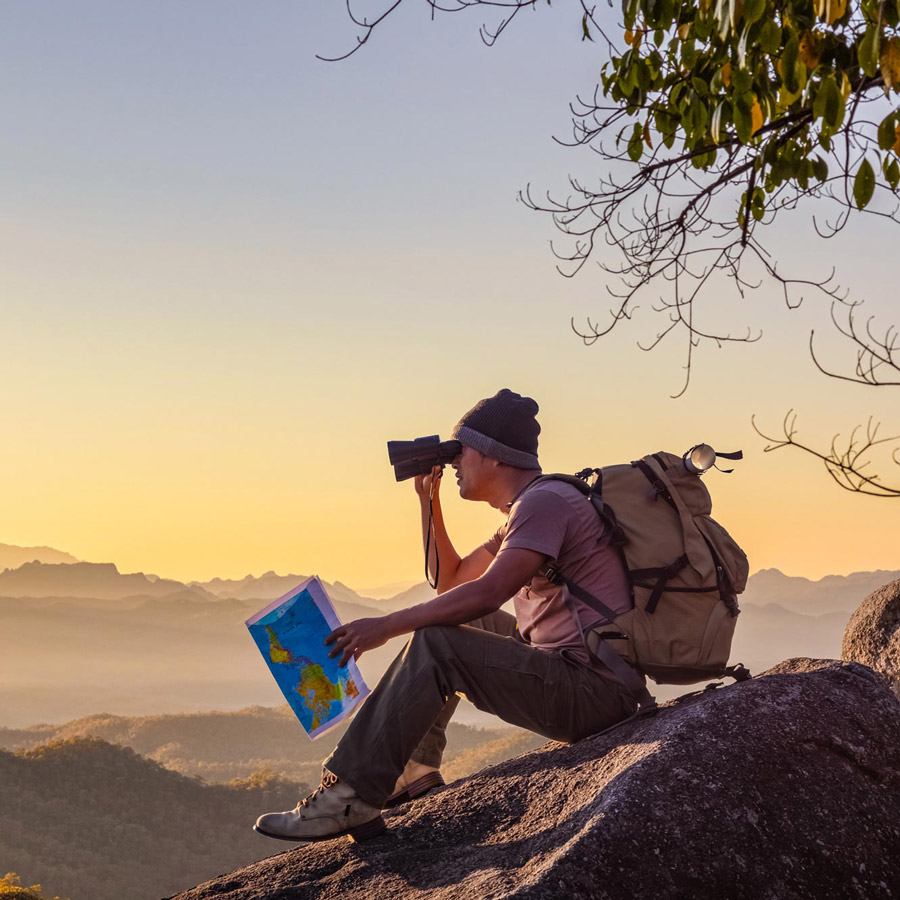

It's like climbing a mountain. It's risky, and if you take the wrong turn, lose your map, or fail to bring the right equipment, you're likely to get into trouble and the consequences are really serious.

However, if you were never told what to bring and where to go, how can you be expected to reach the summit safely?! Especially when other buyers might have a Buyer's Agent on their side.

Okay, the analogy falls down there, but you see the problem, right? So did we.

And that's exactly why we decided to do something about it.

So, we joined forces and distilled our decades of expertise down into a clear system for buying your first home and avoiding all of the common property-buying mistakes! Now you can get your hands on it too...

Introducing: The First Home Buyer Course

The simple, practical and proven 10-step process to get out of your head and into your first home sooner.

The First Home Buyer Course is a 10-module, self-paced course designed to teach you all the steps you need to become an educated home buyer and buy your first home without making a mistake. This course gives you permission to switch off the noise of the well-meaning people around you, and ignore the conflicting voices of other 'experts'... and instead, to listen to the wisdom and practical-advice of two of Australia's most experienced and well-respected Buyer's Agents.

By the end, you'll be equipped with the confidence and skills you need to line up your support crew, avoid costly mistakes, make offers like a pro, and ultimately get into your dream home sooner!

However, if you were never told what to bring and where to go, how can you be expected to reach the summit safely?! Especially when other buyers might have a Buyer's Agent on their side.

The same process you'll have access to has been tried, tested, and proven by first home buyers just like you.

Hear from them yourself...

Antonia & Rinch

Veronica and Meighan are so relatable. We love how down to earth and fun they are. It's easy to understand their explanations and we enjoy discussing the things we're learning. We've gone from overwhelmed and confused, to feeling like buying a home is within our reach. It's actually feeling like a fun and pleasurable journey instead of a maddening task.

Eliot

Hi Veronica, Meighan! My wife and I are in Victoria, and won our first property auction as first-time homebuyers two weeks ago. We couldn't have done it without your course. (We cram-studied the whole thing in 2 weeks!!) Prior to signing up for the course, we would never consider an auction as we thought it was too intimidating - you helped make it possible, thank you so much.

A quick warning before we continue though...

It's important that you know that The First Home Buyer Course is NOT:

Some magical formula to help you accumulate the most government grants...

The same information you could have just found out by asking a real estate agent...

A thinly disguised sales page for house and land packages...

A course for unstable, highly stressed, or financially disorganised people...

Your silver-bullet solution that gives you all the short cuts with none of the effort...

If you're looking for those kinds of resources, you won't find them here!

This course is solid, actionable, no BS training to get you where you want to be without missing a step

From your end, it's going to require a willingness to listen, think differently, and take the right steps in the right order.

And from our end, we promise to provide you with the support, advice, and honesty you need to make the biggest purchase (and decision) of your life with confidence... and hell, even have a bit of fun along the way.

So, if you're here for the right reasons, we're bloody-glad you are. Let's take a look at exactly what you'll learn inside:

The First Home Buyers Course is based in our proven PACE framework responsible for $1B+ in purchases

Made up of four phases with 10 clear steps, this system will help you move from the very start of the journey...all the way through to that pizza-on-the-living-room-floor moment, with the keys to your new dream home in hand!

Here's exactly what we'll cover inside:

PHASE 1: PREPARATION

If you put your right shoe on your left foot and expect to be able to run really fast, you need to rethink your strategy. Buying a home ill-prepared is pretty much the same thing! That's why we'll tackle this first.

In this Phase, you'll learn the importance of:

Building a solid dream-team to support you throughout the process. Learn what questions to ask, who to look out for, and how to use their advice to make really good decisions. It's important to ask the tough questions to the right people early on in the process, so you're never rushing to find support when the time comes.

Setting aside enough money (and not just your 20% deposit!). Using our guidelines, you'll be able to work out exactly how much you need to save to cover all costs. You'll understand the additional costs, why guidance from a broker is key, the pitfalls of taking free money from the government and more.

Planning a realistic home-buying wishlist. Discover which questions to ask yourself, and follow a proven framework to enable you to dream big, and discover what possibilities are available to you! See the bigger picture and make better decisions in the long-run.

PHASE 2: ACTION

Aka. the most exciting phase! Learn the TWO big steps involved in house-hunting the right way.

In this Phase, you'll learn how and why to:

Search and inspect properties you'd actually like to buy. There are right and wrong ways to search for a home, and we'll show you how to avoid limiting yourself or getting overwhelmed by the wrong properties, wrong price ranges and wrong locations. Learn how to deal with agents (they're not your enemy!), speak their language, and decode their answers for your benefit.

Revise and correct to slow down, recalibrate, and make sure you're on the right path. Discover the vital questions to ask yourself to avoid jumping into a bad decision, putting an offer on the wrong house, or giving into pressure unnecessarily. This confidence-boosting step puts you back into the driver's seat of your journey and keeps you safe.

PHASE 3: COMMITMENT

Now it's time to make the (mental) commitment to moving forward, and taking the next steps on that property that's caught your eye.

In this phase, you'll learn the deal with:

All the Methods of Sale and the pros and cons of each. The home you love could be sold by public auction or a private treaty negotiation, and both options matter for a variety of reasons. Learn the process of each method, and whether taking the commitment step is right for you depending on the method.

Evaluating the property to know what it's worth. Learn the importance of due diligence so you know how much you should pay for a property, how to interpret information, use sales data, and assess properties against each other. This step will open your eyes and help you understand whether the compromises and problems you may find in your home are worth it, given your goals and stage of life.

PHASE 4: EXECUTION

It's time to make the offer, sign the papers and get the keys into your hands!

In this phase, we'll walk you through:

Your contract of sale (and any red flags). Know what questions to ask a solicitor or lawyer, and understand your role to educate yourself, and take ownership of your home-buying decision without following an 'expert' blindly.

Negotiation and auction (and why so many people skip too fast to this step). Information is POWER when it comes to negotiation. Have all the steps in place in the right order, and know what conditions you are entitled to before you throw a price at an agent, and save yourself a potentially life-changing mistake.

Your role in your home's settlement. Learn exactly what you need to know and do during the time between contract and settlement, and why this is just as much your job as your solicitor's.

Our goal is to equip you with everything you need to nail your first home buying journey and avoid every mistake in the book.

By the end of this powerful course, you'll be able to:

Know exactly what homes to visit, evaluate, and put offers in on (and when to steer clear).

Build an incredible dream-team to support you through each step and give you the advice you need.

Do everything in the right order (remember: this isn't common knowledge for 99% of people).

Deal with agents with confidence and extract the useful information you need from them.

Understand the different methods of sale and how to negotiate for each one.

Get the undisclosed information you need from agents and sellers to avoid costly mistakes.

Confidently ignore (well-meaning but unhelpful) advice from "experts" in your life and follow your own path.

Avoid making disastrous and costly mistakes purchasing the wrong property for your family.

Buy with your HEAD not just your HEART so you know you've made a smart investment for years to come.

No matter where you're at in your property buying journey...This is the course you need to take your next step with confidence.

The First Home Buyer Course walks you from start to finish through the process of buying your first home. It's perfect for you, whether you're:

Just starting to think about buying a home.

Yep, even without the whole deposit, this course is the best place to start to ensure you know exactly how much to save and what your timeline looks like.

Cashed up and ready to house shop.

Avoid jumping in too fast, and paying later! This course will walk you through the essential steps to avoid heartbreak and disappointment along the way.

Facing offer-rejection disappointment.

Putting offers in left, right and centre with no luck? This course will show you whether you're missing vital steps that could be sabotaging your success.

About to sign your life away to a loan (and freaking out!)

Stay in control right through to the end! Access training to help you deal with due diligence, contracts, negotiation and settlement, so you can avoid costly mistakes.

This course is packed to the brim full of incredibly powerful information to equip and empower you to buy your first home. But - we're also aware that every first home buyer's situation is unique, and sometimes specific questions, issues, and ideas arise that you need to hash out with an expert.

That's why, when you sign up for The First home Buyer Course today, you'll get 30-days access to CAMPFIRE: Weekly Live Q&A, hosted on Zoom. These small group sessions are your opportunity to get your burning question answered, stay accountable, and receive up-to-date information on what's new in the property space.

PLUS, you'll have access to a Members Only 'Ask Anything' forum between sessions, so you can connect, share, and learn from like minded people on the same journey as you.

After the 30–days, if you still want ongoing support across your journey, you can continue your membership for $99/month - no lock-in contracts, we're here as long as you need us.

*Get 30-days access to CAMPFIRE: Weekly Live Q&A on Zoom

And the best part of this bonus is, you can dive inside The First Home Buyer Course today...

And only kick-off your CAMPFIRE: Weekly Live Q&A Support when you're 100% ready!

We encourage you to jump into this course as early as possible - before you've even got a deposit is often the best time to start. Sometimes though, you may not need Live Q&A support until further down the track. We want to make sure you've got the advice you need, when you need it, which is why we offer the option to delay access to your live Q&A bonus!

You can simply secure access to The First Home Buyer Course today, dive into the content, and just let us know when you're ready for your 30-days of CAMPFIRE: Weekly Live Q&A to begin.

Remember though: the home buying process starts long before you're ready to put an offer in. Our support can help you at every single step in the journey, and it's never too early to get educated, build a support system, and own the process.

*Get 30-days access to the CAMPFIRE: Weekly Live Q&A Sessions

Access everything you need to buy your first home with confidence, all in one place.

Receive unlimited access to the The First Home Buyer Course video training, downloads, and action-steps.

Master the 10 step PACE system for yourself with support along the way

Ask questions and get expert advice from Meighan and Veronica through the members-only "Ask Anything" forum

30-days access to CAMPFIRE: Weekly LIVE Q&A sessions with Meighan and Veronica to answer your questions and keep you on-track (then $99/month - cancel anytime)

BONUS: Get a FREE copy of Veronica's book: AUCTION READY, how to buy property at auction even though you're scared s#!tless! (Valued at $29)

FREE copy of the popular, 2-hour Where to Buy Tutorial (Valued at $39) to teach you the simple, little-known method for working out what you can afford to buy in any location.

$990

Join risk-free with our 30-Day Money-Back Guarantee...

We get it - saving a deposit for a home is a significant investment enough, let alone throwing another cost into the mix.

While we're confident that this course can save you thousands throughout the process, we also know that you may not be ready to take that risk. So, we want to make it a no-brainer for you to jump inside The First Home Buyers Course, get your hands dirty, and see for yourself just how game-changing this training can be.

That's why if you don't find value from this course, simply cancel within your first 30-days and we'll give you 100% of your money back, no questions asked.

Now it's a no brainer, right?!

Hear from these happy first time home owners:

Keira

I signed the contract on my first home yesterday. I had an awesome support team (broker and, especially, lawyer), a long and elaborate spreadsheet of sales info in the area, and above all, the confidence to go through with it all.

All of this was built on the foundation of your advice via the PACE system. I knew what was going on, I knew what to ask and when, I knew when to disclose info and when to be a little bit vague - generally how to deal!

...Without that guidance I'm not sure I'd ever have gone through with it. I'd probably be saving a deposit forever, bemoaning Sydney's outrageous prices, and generally sitting on the sidelines. Instead, you helped me play the game.

Jake

Having recently purchased my first property, I can honestly say Meighan (and Veronica's) advice has been invaluable and always stuck in my head. Their advice is genuine, comes from years of constant experience, and is the perfect place to gain unbiased property purchasing knowledge. Highly, highly recommend!

Find out more about your mentors:

Veronica's Story

Veronica Morgan is the Founder and Principal of Good Deeds Property Buyers. She is also the co-host of the popular series Location Location Location Australia with Bryce Holdaway and also Relocation Relocation Australia on Foxtel's The Lifestyle Channel Australia. You can also tune into Veronica as she co-hosts the The Elephant in the Room property podcast, which investigates who is really in control when you buy property. She's recently released her first book, Auction Ready: how to buy property at auction even though you're scared s#!tless!

Veronica is passionate about residential real estate and knows first hand the importance of owning and living in the right property. Prior to "jumping the fence" and becoming a buyers' agent, she was an acclaimed sales agent in a leading independent agency in Sydney's Inner West.

Since forming Good Deeds Property Buyers in 2009, Veronica has become a credible (and often controversial) source of opinion on Sydney's property market. Amongst other things, she is a regular guest co-host on Your Money "Auction Day" (formerly Sky News Real Estate), has presented at Grand Designs Live Australia, been a REINSW awards judge, was a keynote speaker at the REINSW Women in Real Estate Conference in 2012 & 2019, served as Vice President of REBAA and has written numerous articles for mainstream and industry publications including The Sydney Morning Herald's Domain magazine, Inside Out, Australian Property Investor, Your Investment Property & Smart Property Investment magazines.

Veronica Morgan is a Licensed Real Estate Agent, a Qualified Property Investment Adviser® as well as holding a Bachelor of Design (Visual Communications) and a Masters of Commerce (Marketing).

Meighan's Story

Meighan Wells bought her first property at 23 and hasn't stopped since. With a Masters in Business Administration (MBA) and degrees in psychology and human resources, as well as having experience as a licensed real estate agent, Meighan has a great appreciation for both the emotional and logical drivers of purchasing a property as well as an acute grasp of both contract and property law.

As the Founder of Brisbane buyers' agency Property Pursuit, Meighan is committed to excellence and the swelling list of satisfied clients as well as its multi-award-winning status is a testament to her ethics and hard work. In recognition of her expertise and high standards in the fast-growing buyer's agency industry, Meighan was engaged to develop and deliver the education module for the REIQ course Acting as a Buyer's Agent and was the Chairman of the REIQ Buyers' Agent Chapter for 4 years.

In 2010, Meighan was awarded the highest honour for buyer's agents when she was recognised as the REIQ Buyer's Agent of the Year for the third consecutive year. As a recognised expert on the Queensland property market, Meighan is regularly featured in the media in publications including The Financial Review, The Australian, The Courier Mail, Sunday Mail, Sydney Morning Herald, Australia Property Investor Magazine, Your Mortgage Magazine, Realestate.com.au, Domain.com.au, Property Observer and more.

The way we look at it, you have two options...

Option 1: Give it a crack on your own (after all, that's how everyone does it, right?!)

You can keep stalking real estate sites, visiting open houses, saving like crazy, and putting in offers for house after house...

And sure, you may end up with a home at the end of it, but at what cost?

Everyday you navigate this path without a roadmap or a guide, you're putting yourself at risk of making costly mistakes. You risk paying too much, buying a lemon, making the wrong offers, failing due diligence, getting scammed by agents, borrowing too much (or not enough), and so much more.

So, you can tread this road alone, hoping that you make it to the other side unscathed...

Or, you can choose Option 2: Enlist a guide to help you get from where you are to where you want to be!

Educating yourself on the home buying process is your responsibility - but you don't know what you don't know, right?!

By enlisting the help of a guide who is a true expert in home buying (and no, we don't mean your Uncle Bob who's got a few investment properties and thinks he's a guru)... an expert who has been through the trenches, navigated their way through every buying scenario, and helped thousands of people get onto the property ladder...

You can experience the home-buying process you deserve! You can actually enjoy finding your dream home, feel in-control, and know you're making the best decision for your future - guaranteed.

The choice is yours...

Got burning questions? Check out these FAQ's...

What are the steps involved in buying a home?

Good question! Inside The First Home Buyers Course, this is exactly what we cover. This program sets out the exact steps you need to take, in the right order to get into your first home (and avoid the same mistakes others make).

How much can I afford to spend on a home?

Module 2 covers this in all the detail you'll need. If this feels like guesswork right now, don't worry - we'll share the simple process to determine this with you.

How do I find the right home for my needs, and what should I look for when viewing properties?

When you sign up to The First Home Buyers Course, we're adding in a bonus tutorial called: Where To Buy. This will be invaluable for you as it covers a simple process for working out exactly this. Plus, in Module 4 of the main program, we'll cover what to look for at open house inspections in great detail.

How do I make an offer on a property, and what factors should I consider when negotiating a price?

The First Home Buyer Course includes a detailed mini course on how to price a property like an expert. In addition, there are loads of factors, such as the method of sale (module 6), whether any issues have been uncovered during due diligence (module 7), working out the agent's offer process and negotiating with intent (module 9)...and more. We'll cover it all in this program.

What happens during the home inspection process, and what should I be looking for?

Module 5 will cover all this, so you know exactly what to look for at your next home inspection.

What are the closing costs associated with buying a home, and how much should I expect to pay?

Get advice from the experts, of course! And do everything in the right order, without missing a step. We promise you, it is possible (and worth it).

What resources are available to first-time homebuyers, and how can I take advantage of them?

First Home Buyer Grants are the main one - they differ state by state and sometimes encourage first home buyers to buy poor assets, so beware. This course is designed to help you understand when these are good for you and when they're not.

How do I avoid common mistakes that first-time homebuyers make?

Short answer? Get inside The First Home Buyers Course asap! Longer answer? Buying a home can feel like you're climbing a mountain, and without a guide, it's inevitable you'll get off track at one point or another. The risk is, how much will that mistake cost you along the way? The best way to make sure you stay on-track and get into your first home without the common pitfalls that hit most first home buyers is to follow a proven process - do the right things, in the right order, without missing a step, and you're sure to enjoy a helluva lot more smooth sailing than the alternative. This course will show you how to do exactly that.

How can I prepare financially and emotionally for the home buying process?

Buying a home is a big decision, and it's okay to take your time and do your research before making any commitments. Emotionally, it's natural to feel excited but also overwhelmed or anxious during the home buying process. Just remember that these feelings are perfectly normal. The best antidote in our opinion is expert advice and a sound plan to follow.

Financially, it's crucial to start by setting a budget, start saving and get into healthy money habits.

You should also make sure to check your credit score and take any necessary steps to improve it if needed, as this can affect your ability to secure a loan and the interest rate you'll be offered. It's also important to build up a solid emergency fund, as unexpected expenses can arise during the home buying process or after you've moved in.

Is there a guarantee? How do I claim it?

Yep! While we're confident that this course can save you thousands throughout the process, we also know that you may not be ready to take that risk. So, we want to make it a no-brainer for you to jump inside The First Home Buyers Course , get your hands dirty, and see for yourself just how game-changing this training can be.

That's why if you have completed less than half of the course and are not satisfied, simply cancel within your first 30-days and we'll give you 100% of your money back. no questions asked. Just get in touch with us via email and we'll sort it out for you.

How do I delay my access to the CAMPFIRE: Weekly Live Q&A sessions? How long can I delay it for?

Easy! You only start your access to the Live weekly Campfire Q&A sessions by using your Golden Ticket when you are ready. You can do the whole course, get yourself ready to buy then just start your Campfire Q&A access when you are close to buying. You'll just need to use your Golden Ticket within 365-days of purchasing the course to get your free 30day access.

When is the best time to jump inside The First Home Buyer Course?

Honestly? The best time to jump in is before you're "ready". You don't even need a deposit saved (we can help you get clear on how much you need anyway). However this course really is designed to help you at every stage of the journey, no matter where you're up to. The home buying process starts long before you're ready to put an offer in. Our support can help you at every single step in the journey, and it's never too early to get educated, build a support system, and own the process.